This Billionaire’s Secret Strategy Beats Passive Investing By 5,500%

Not only did this strategy survive the ‘87 crash, the dotcom bust and the subprime panic—it thrived during all three—and turned a $1,000 investment into $66.7 million today…

...compared to $1.2 million buying and holding the S&P 500

Dear Investor,

2019 has been a wild ride.

And I assure you, 2020 promises to bring new trends...

...new laws… new tariffs… increased volatility… and increased geopolitical upheaval…

...maybe even a market crash.

Those who follow this simple but powerful investing strategy can protect, revive, and even multiply their retirement savings by leaps and bounds.

Here are some examples of the gains this strategy recently generated:

From Bloomberg:

The recent flood of money into index funds has parallels with the pre-2008 bubble in collateralized debt obligations… Burry, who made a fortune betting against CDOs before the crisis, said index fund inflows are now distorting prices for stocks and bonds in much the same way that CDO purchases did for subprime mortgages more than a decade ago. The flows will reverse at some point, he said, and “it will be ugly” when they do. “Like most bubbles, the longer it goes on, the worse the crash will be.”

Here’s the thing, using this unconventional strategy can help you protect and safeguard your retirement savings, but you’ll also have the opportunity to grow your wealth 5,500% faster than passive investing.

I’ll show you how just ahead.

My name is Jesse Webb

Big Institutions Always Create The Most Profitable Trends

Without fail, when big institutions start putting large sums of money to work in a certain market, it will ultimately create a strong uptrend or bull market and you can earn big profits.

And when they start pulling money from a market and moving to cash, it will ultimately create a strong downtrend or bear market and you can earn big profits.

Let me show you what I mean:

From 2011 through early 2016, the price of gold had been in an ugly downtrend losing -45% of its value as it dropped from $1,900 an ounce to just over $1,000 an ounce.

But then look what happened. Price stabilized as big institutions and central banks started buying gold causing a new uptrend to emerge.

Central Banks Just Love Gold and It's Going to Stay That Way - Bloomberg, August 26, 2019

Central banks make record $15.7bn gold purchases

- Financial Times, July 31, 2019

- Financial Times, July 31, 2019

In 2018 Central banks bought the most gold by volume since 1967 - CNBC, January 31, 2019

Here’s the thing, without a sophisticated algorithm constantly monitoring both buying and selling pressure, it’s impossible to know what the big institutions are doing.

And if you wait until a new trend is obvious to everyone before buying in, the trend may be ready to reverse again, or at least experience a sharp correction, and you risk losing a great deal of money.

In order to create life-changing wealth as a trend following trader, you need to get into these new trends early.

That’s where I come in.

I’ve spent the last twelve years and over $500,000 developing, programming, and perfecting my own proprietary trend following algorithm into an easy-to-use software that offers a successful trend following strategy to ordinary investors like you and me.

Yes, I was a little ahead of my time when I first started coding my artificially intelligent trend following system which I’ll tell you more about just ahead.

Big Institutions Jump Ship On Passive Investing

Why Trend Following Is Superior To Buy And Hold Investing

Step 1 - Accurately Identify The Long-term Major Trend

TradersPro has accurately timed the major market trend with 85.7% accuracy since 1970.

As a user of TradersPro you don’t have to worry about trying to figure out market direction on your own.

As you can see in the chart above, each time there is a major shift in the trend, you’ll be alerted so you can profit in both up and down markets.

Like I said, getting the major market trend right is 90% of the battle to consistently making money in stocks.

But the difference between buying an average stock or a market leader can be life changing, as you’ll see just ahead.

Step 2 - Concentrate Your Portfolio In The Strongest Stocks

For example

In February of 2018 TradersPro gave a buy signal on Tandem Diabetes Care (TNDM) around $3 per share.

Over the next 8 months the stock ran to as high as $52 per share before triggering a sell signal around $36 per share.

That's a 1061% return in only 8 months turning at $10,000 investment into 106,100.

Compare that to buying Apple, a Wall Street favorite, whose share price only climbed 29% over the same time frame - turning $10,000 into $12,900.

And then there's Turtle Beach Corp (HEAR), whose share price exploded 4330% between February and August of 2018.

That means a $10,000 investment ballooned into a mind-blowing $433,000 in only 6 months...

...compared to only growing into $15,300 buying Netflix.

Now I’m not “hating” on Investing $10,000 into both Apple and Netflix, and watching it grow into $28,200 over 8 months…

...it's just not the same as investing $10,000 into both Tandem Diabetes and Turtle Beach and watching your money swell into $539,400 in only 8 months - now that's life changing!

Step 3 - Execute

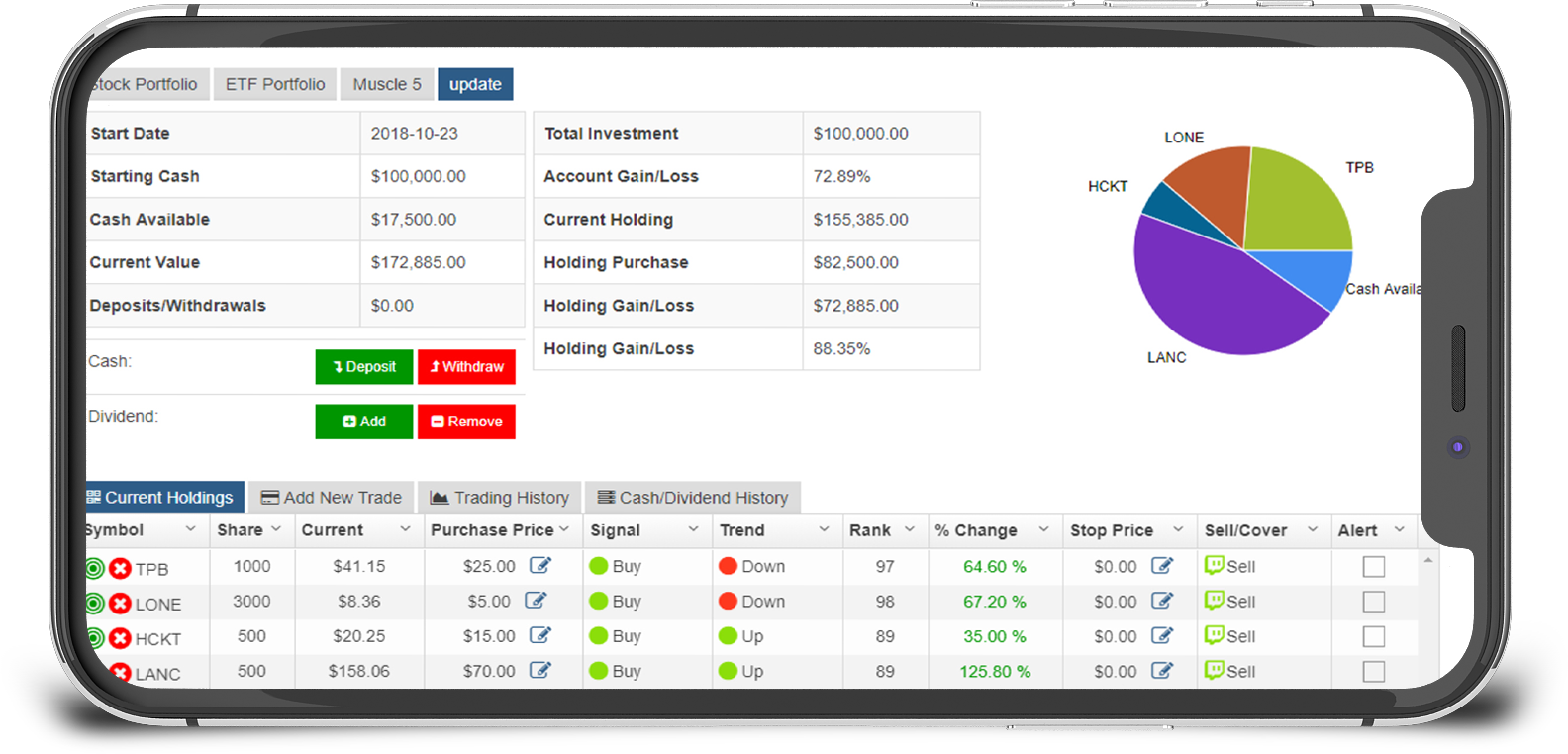

TradersPro analyzes thousands of US & Canadian stocks and ETFs with a sophisticated algorithm that detects very early momentum.

It then ranks those stocks from strongest to weakest in both up and down markets and spits out unemotional buy and sell signals. All you have to do is follow the system and don't deviate from it.

The stocks are clearly listed out for you...and you already know the market trend. Now simply execute.

Even starting with only $10,000 and investing in market leaders, then repeating this process year after year (reinvesting your profits of course), it’s possible that your $10,000 grows into six and eventually seven-figures or more.

Step 4 - (Bonus Step For Aggressive Traders Only)

What about when the market turns down?

Rest assured TradersPro will have you sitting safely in cash when the market starts trending down or worse crashing.

And if you are an aggressive trader, and want to short the market, TradersPro can help you rack up some impressive gains quickly.

Let me show you what I mean:

TradersPro predicted the October - December 2018 bloodbath well in advance.

TradersPro Buy/Sell Ratio, which is a short-term timing and trend signal, started to indicate selling activity almost a full week before October 10th, right before the Dow plunged 4,000 points into Christmas Eve.

Whether shorting stocks or buying put options, the gains you could have realized during a 4,000 point meltdown would have been staggering.

But then something interesting happened with the buy/sell ratio. On Christmas Eve It hit its lowest reading over the prior 12 months…

...indicating full selling exhaustion...and that the smart money was now buying the bottom hand over fist.

That means your $10,000 investment would be worth just over $29,000 after exactly 51 calendar days.

How high will Emisphere go? I have no idea.

What I do know is that TradersPro will keep you invested as long as the stock remains strong and continues trending higher.

And the minute the trend strength becomes weaker, TradersPro will issue a sell signal - helping you lock in a tidy gain.

Now you can see why trading the strongest stocks is critical to making big money. You’ll do well if you get the trend right, but you can create a fortune if you invest in the strongest companies.

Here’s What Other TradersPro Users Are Saying

"I wish I had found it sooner!"

So far so good. I have made money on every trade executed thus far and I am also making money on 2 trades that I am still holding. It's been the tool that I have been looking for and wish I had found it sooner. It gives me the discipline I need. I will let you know if my success continues.

-Piero T.

"Helps me to make a better decision."

What I like about TradersPro is that I don't have to look for the stocks that are moving, it shows them to me. It also helps me to make a better decision when to sell. I used to hold on to my favorites too long and lost my profits or I sold too early and missed the gains that I could have had. I move in and out of stock a lot more now. I have made gains of approximately 10% since I started using your product less than two months ago.

-Joel V.

I have been investing for about 3 months, starting with $40,000. The net gains on the investments have been $6,400 to date, representing a 16% return, annualized to 64%.

-David S..

I first started in the stock market by reading a book written by Nicolas Darvas...His basic method was quite similar to yours...The price of the subscription was really good, so I didn’t have much to lose. Your system corresponded to exactly what I needed and is 1000 times better than I expected. I started with your system 3 months ago. As of today I have a gain of 26.04%.

-Louis D.

...Bonus Items Worth $1255 That I’m

Including Absolutely Free

Bonus #1

How To Make Money Trading Stocks

($79 value)

How To Make Money Trading Stocks

($79 value)

When it comes to picking winning stocks, TradersPro does all the heavy lifting. Sifting through 15,000 stocks and ETFs each day…allowing the cream to rise to the top in an organized and actionable list.

202 Page e-book

But how much capital should you put in each positions? What do you do once your position has doubled in value? Do you sell half and ride the other half? When does it make sense to keep holding the entire position?

My 202 page e-book “How To Make Money Trading Stocks” walks you step-by-step through successful trade management - including money management, position sizing, risk to reward ratios, and various entry, trailing, and exit techniques.

Just one little tidbit from the book, such as my favorite trailing technique, could pay for your entire subscription to TradersPro for several years.

Bonus # 2

Three exclusive reports detailing the most dominant and upcoming economic mega-trends, and the absolute best way to make money from these new and disruptive technologies.

Three exclusive reports detailing the most dominant and upcoming economic mega-trends, and the absolute best way to make money from these new and disruptive technologies.

Report # 1

The Medical Marijuana Boom

($19.95 value).

Whether it’s Constellation Brands taking a huge stake in Canopy Growth or Molson Coors announcing a joint venture with HEXO corp. Or Coca-Cola in talks with Aurora Cannabis, there’s no shortage of “buzz” around the legalization of marijuana for both medicinal and recreational uses.

The Medical Marijuana Boom

($19.95 value).

Whether it’s Constellation Brands taking a huge stake in Canopy Growth or Molson Coors announcing a joint venture with HEXO corp. Or Coca-Cola in talks with Aurora Cannabis, there’s no shortage of “buzz” around the legalization of marijuana for both medicinal and recreational uses.

It’s estimated to become a $32 Billion industry by 2022 with the potential to ultimately become a $500 Billion industry. Since this report was first written, my #1 marijuana stock is already up over 150%, but it’s not too late to get in.

These kinds of momentum stocks often gain 1,000% to 5,000%. It’s all spelled out in this special report.

These kinds of momentum stocks often gain 1,000% to 5,000%. It’s all spelled out in this special report.

Report # 2

Pay Attention To 5G

($19.95 value)

It’s not just faster phones. 5G is a massive breakthrough technology...200 times faster than 4G...that will reshape everything it touches. Control virtual objects with other people simultaneously.

Pay Attention To 5G

($19.95 value)

It’s not just faster phones. 5G is a massive breakthrough technology...200 times faster than 4G...that will reshape everything it touches. Control virtual objects with other people simultaneously.

Put on a headset and fly a drone or drive a car that’s somewhere else, in real life. Or better yet, let it drive itself. That’s what’s coming with 5G and it will create enormous wealth for those who understand how to profit from this new mega-trend. It’s all detailed in this special report.

Report # 3

Rise Of The Machines

($19.95 value)

It’s estimated that global spending on Artificial Intelligence will reach $57.6 billion in 2021 and could add $15.7 trillion to the world economy by 2030.

Rise Of The Machines

($19.95 value)

It’s estimated that global spending on Artificial Intelligence will reach $57.6 billion in 2021 and could add $15.7 trillion to the world economy by 2030.

AI is not an investment fad, experts unequivocally see AI as a genuine long-run wealth creation opportunity with the scope to enrich all of our lives in multiple ways - from smartphones to smart cars, to smart fridges, to ways we haven’t even thought of yet.

Those who get in early stand to make a fortune. This report lays it all out and helps you understand the best ways to increase your wealth from this upcoming mega-trend.

Those who get in early stand to make a fortune. This report lays it all out and helps you understand the best ways to increase your wealth from this upcoming mega-trend.

Bonus # 3. Unlimited Access To 9 TradersPro Premium Features ($1,117 value)

TradersPro Premium Features

Custom Stock & ETF Screener

Search thousands of U.S & Canadian Stocks and ETFs and drill down for signals with additional advanced criteria only found on TradersPro, like signal changes and bullish/bearish extremes.

Search thousands of U.S & Canadian Stocks and ETFs and drill down for signals with additional advanced criteria only found on TradersPro, like signal changes and bullish/bearish extremes.

($97 Value)

Watch Lists

Unlimited Watch Lists - Get email alerts when your stocks have perfect trade setups. Import and Export csv or xls files for fast analysis.

Unlimited Watch Lists - Get email alerts when your stocks have perfect trade setups. Import and Export csv or xls files for fast analysis.

($67 Value)

How To Make Money Trading Stocks

202-Page book of a specific systematic strategy. Learn the TradersPro method step-by-step.

202-Page book of a specific systematic strategy. Learn the TradersPro method step-by-step.

($79 Value)

Ad Free Display

Removes display ads from the Analysis section of the site.

Video Training Sessions

Detailed training videos to get you up and running on TradersPro, Backtest All and the Reversal Plugin fast! ($149)

10 New Predefined Stock Scans

OneClick Scan Results • Smooth Sailin

OneClick Scan Results • Smooth Sailin

Muscle Minis • Break Outs • Bottoms Up • Weaklings • Put Sells • Top Dividend Stocks

CryptoCurrency • Spring Loaded • Sell to Buy

($197 Value)

Reversal Strategy Plug-in

Full Reversal Strategy application plugin

and training videos. Provides additional signal options that can help you pinpoint when a stock is about to change directions.

($197 Value)

($197 Value)

Backtest & Backtest-All Plugin

Backtest entire lists of stocks at once to find prime trade setups. Ideal stocks ready to move.

($97)

($97)

Stock Analysis Reports

Reports are full trend and fundamental analysis on any stock. Trend signals, key fundamental patterns, backtest data and analysis all on one easy to read page. Save to PDF as well for a printable format.

($97 Value)

($97 Value)

Don’t delay! The next 50 subscribers will get everything I’ve just laid out for you, including a full 12-month subscription to TradersPro for only $79.

That’s just pennies a day. At that price, you'd be tripping over thousands of dollars to save a few measly pennies. It's a no-brainer!

You’ll get an entire year of UNLIMITED access to TradersPro - including your 9 additional Premium Features.

That means you can login 24 hours a day, 365 days a year to screen for stocks that are ready to make BIG moves like 190% in 51 days, 1100% in 8 months, or 4300% in 6 months.

Timing is everything. The Markets are changing quickly and you're going to want to know what my system is saying right now about the current market direction.

Plus, TradersPro has just uncovered a handful of stocks that are trending higher and about to go parabolic - you’re not going to want to miss these.

I'm confident you’ll absolutely love TradersPro, but to remove any and all risk to you, I back everything with my 100% Ironclad 30-Day Money-Back Guarantee:

If you’re not happy with the TradersPro system, or if it's just not what you’re looking for, I’ll refund your entire purchase price, no questions asked, no problem, within 30 days of your purchase date.

Plus, you can keep your copy of “How To Make Money Trading Stocks” and your 3 exclusive reports, covering the hottest economic mega-trends absolutely free, as my way of saying thank you for trying TradersPro.

Finding a list of fast moving stocks in 10 minutes… stocks that can potentially move 1100% to 4300% in less than a year...is nothing short of exciting.

You have nothing to lose and everything to gain.

Copyright 2018 - TradersPro.com - All Rights Reserved

Privacy Policy | Disclaimer, Terms & Conditions

Privacy Policy | Disclaimer, Terms & Conditions

2018 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Fundamental company data provided by Morningstar and Zacks Investment Research. Information is provided 'as-is' and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use please see disclaimer.

Investing is Inherently Risky

There are risks inherent in all investments, which may make such investments unsuitable for certain persons. These include, for example, economic, political, currency exchange, rate fluctuations, and limited availability of information on international securities. You may lose all of your money trading and investing. Do NOT enter any trade without fully understanding the worst-case scenarios of that trade. And do NOT trade with money you cannot afford to lose. Past performance of an investment is not necessarily indicative of its future results. No assurance can be given that any implied recommendation will be profitable or will not be subject to losses.

Hypothetical Results Are Reported

Results and examples used in the Company’s advertisements, books, videos, websites, and other media—including on the Site and the Network—are, in some cases, based on hypothetical (simulated) trades. Plainly speaking, these trades were not actually executed. Hypothetical performance results have certain limitations. Unlike an actual performance record, hypothetical results do not represent actual trading. Also, since the trades have not been executed, the hypothetical results may have under-or-over compensation for the impact, if any, of certain market factors, such as lack of liquidity. Hypothetical trading programs generally are also subject to the fact that they are designed with the benefit of hindsight. Hypothetical results also do not account for commissions or slippage.

The Company’s simulations assume purchase and sale prices believed to be attainable. Yet traders are going to be getting into trades at different times and using various exit approaches, which may result in different pricing and outcomes. You may or may not receive the best available price on the purchase or the sale of a position in actual trading.

Information provided by the Company is not investment advice. The Company is not a registered investment adviser, stock broker, or brokerage. You agree that the Company does not represent, warrant, or take responsibility that any account will or is likely to achieve profit or losses similar to those shown. Examples published by the Company are selected for illustrative purposes only. They are not typical and do not represent the typical results of all stocks within the Company’s software or its individual scans and searches. No independent party has audited any hypothetical performance contained at this Web site, nor has any independent party undertaken to confirm that they reflect the trading method under the assumptions or conditions specified.

Offers Disinterested Commentary and Analysis

The Company does not receive any form of payment or other compensation for publishing information, news, research, or any other material concerning specific securities on the Network that is intended to affect or influence the value of securities. The Company, and its personnel, do not engage in front-running of recommendations and do not trade against one’s own recommendations.

The Company and its management may benefit from an increase or decrease in the share prices of the profiled companies, and/or may have other actual or potential conflicts of interest. If a particular security featured in a newsletter publication is concurrently owned by the Company in its corporate brokerage account, or in any of the individual accounts of the Company’s principals or analysts / writers, that fact will be disclosed. The Company, its principals, analysts and writers may choose to purchase a security or derivative featured in one of its newsletter publications, but typically will wait three (3) trading days from the date of publication before initiating said purchase.